News

- New draft: Patent Disclosure and Reliance on External Financing

- In Print at Review of Finance: “Revisiting Board Independence Mandates: Evidence from Director Reclassifications” (with Jerome Taillard)

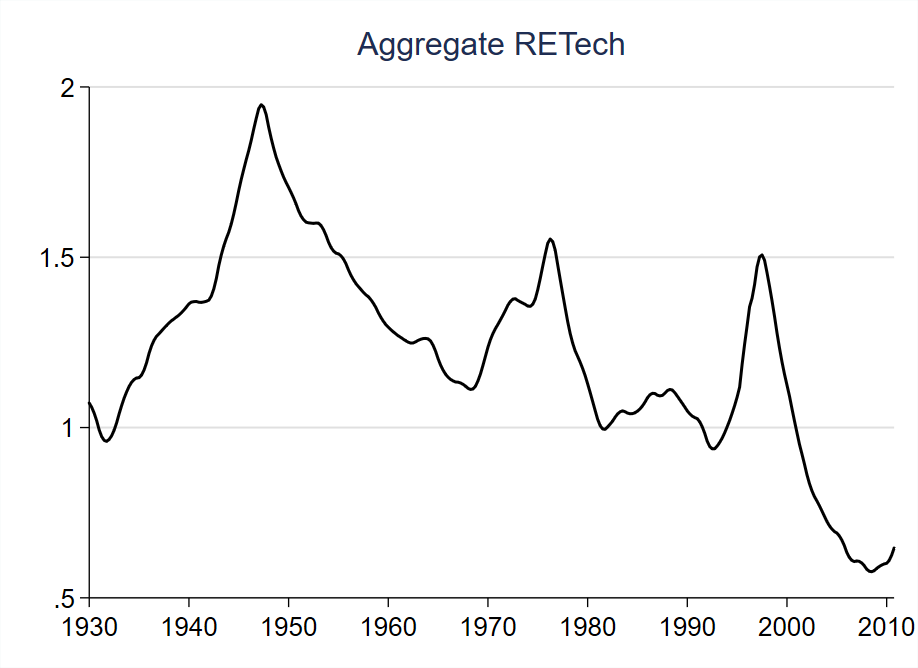

- RETech data updated through 2024!

Publications

Rapidly Evolving Technologies and Startup Exits (with Gerard Hoberg and Laurent Fresard)

(SSRN Link) (Official link) (Replication kits: analysis and measure construction) (Plug and play data for researchers!)

(Ask AI about the paper) (Machine readable version)

Media: Tuck Forum on Private Equity and Venture Capital

Management Science (2023) 69:2: 940-967

Formerly titled “Technological Disruptiveness and the Evolution of IPOs and Sell-Outs”

NPR Style Summary

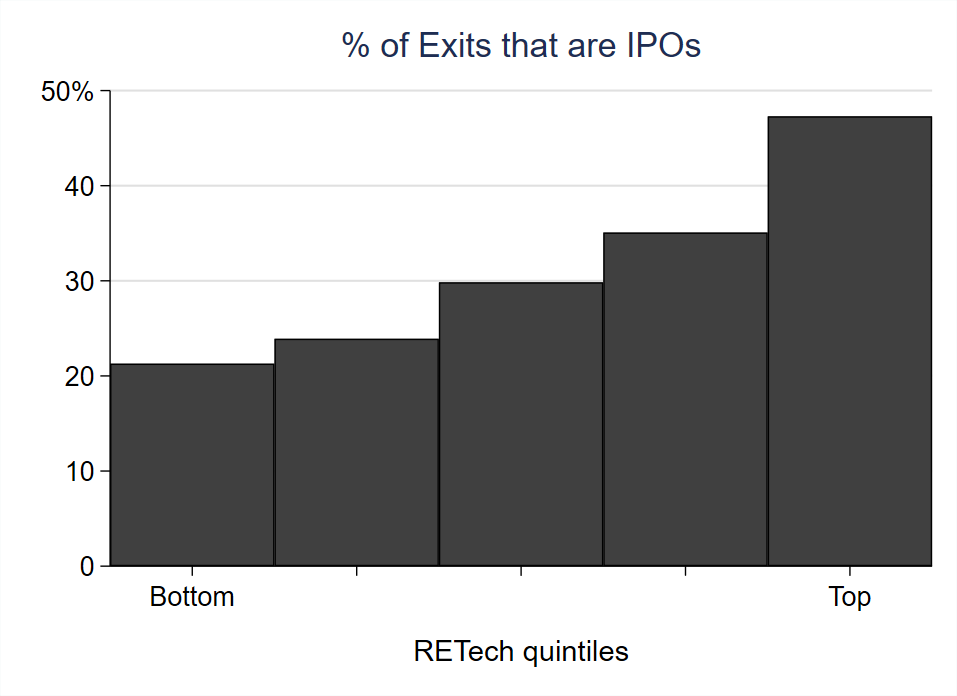

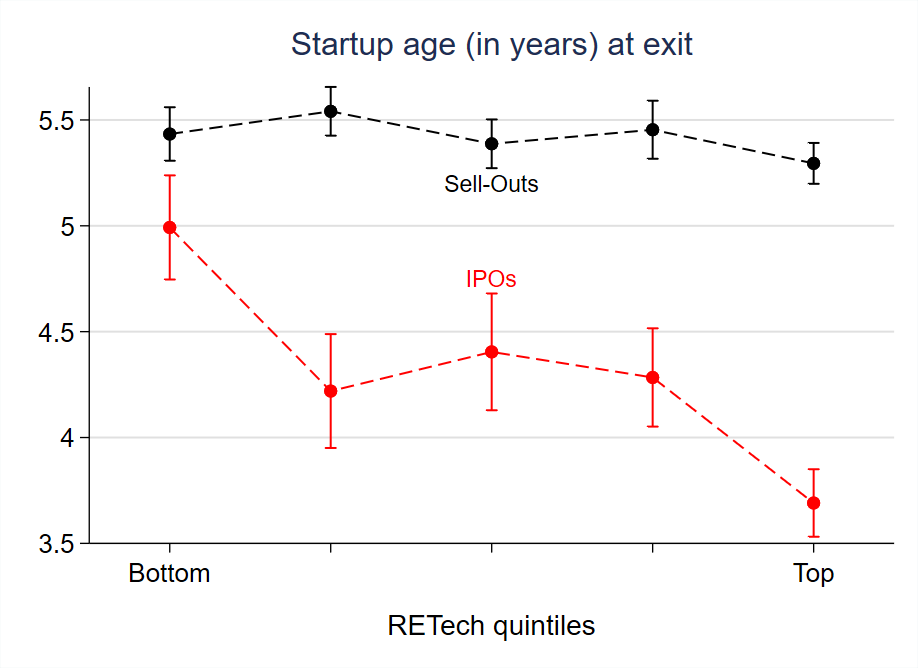

This paper examines startups’ positioning within technological cycles. We use patent text to measure whether innovation pertains to a technological area that is rapidly evolving or stable. We show that innovation in rapidly evolving areas (i.e., early in the cycle) substitute for existing technologies, whereas innovation in stable areas (i.e., later in the cycle) complement them. Our new measure is distinct from existing characterizations of innovation and is economically important. We find that startups in rapidly evolving areas tend to exit via IPO, thus remaining independent, consistent with technological substitution. In contrast, startups in stable areas tend to sell-out, consistent with technological complementarity and synergies.

What’s your identification strategy? Innovation in corporate finance research (with Laurent Fresard and Jerome Taillard)

Management Science (2017) 63(8): 2529-2548

NPR Style Summary

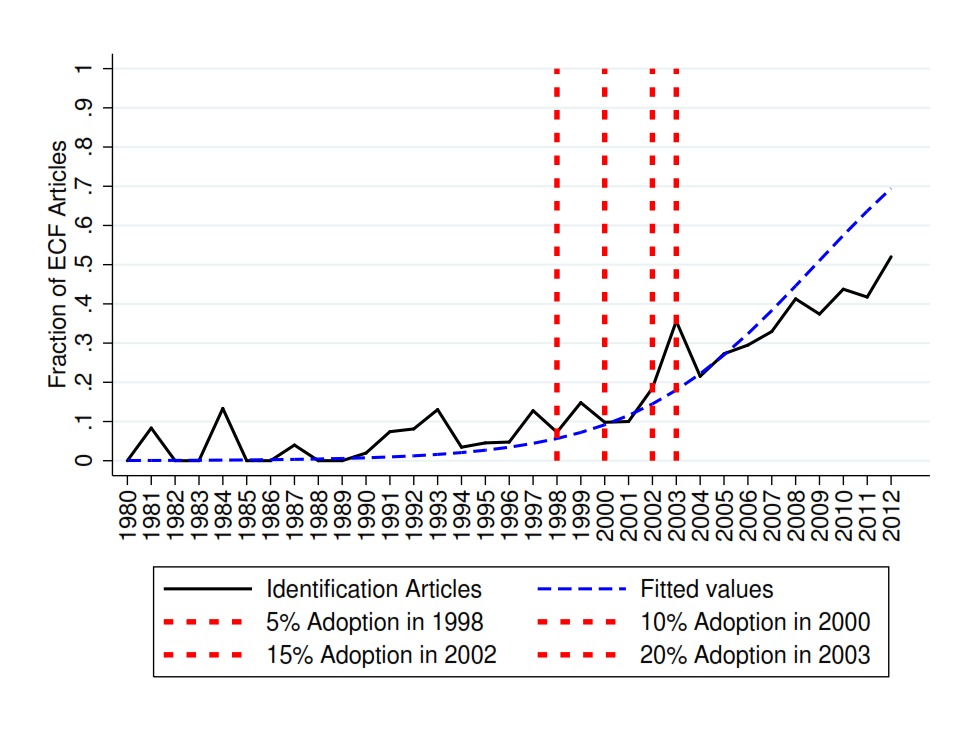

We study the diffusion of techniques designed to identify causal relationships in corporate finance research. We estimate the diffusion started in the mid-nineties, lags twenty years compared to economics, and is now used in the majority of corporate finance articles. Consistent with recent theories of technology diffusion, the adoption varies across researchers based on individuals’ expected net benefits of adoption. Younger scholars, holders of PhDs in economics, and those working at top institutions adopt faster. Adoption is accelerated through networks of colleagues and alumni and is also facilitated by straddlers who cross-over from economics to finance. Our findings highlight new forces that explain the diffusion of innovation and shape the norms of academic research.

Revisiting Board Independence Mandates: Evidence from Director Reclassifications (with Jerome Taillard)

Review of Finance, Volume 29, Issue 3, May 2025, Pages 747–777, https://doi.org/10.1093/rof/rfaf010

(SSRN link) (Official Link – Open Access) (Published PDF) (Data and replication code/kit)

(Ask AI about the paper) (Machine readable version)

(Previously titled “Were non-independent boards really captured before SOX?”)

Media mentions: Columbia Law School’s Blue Sky Blog

NPR Style Summary

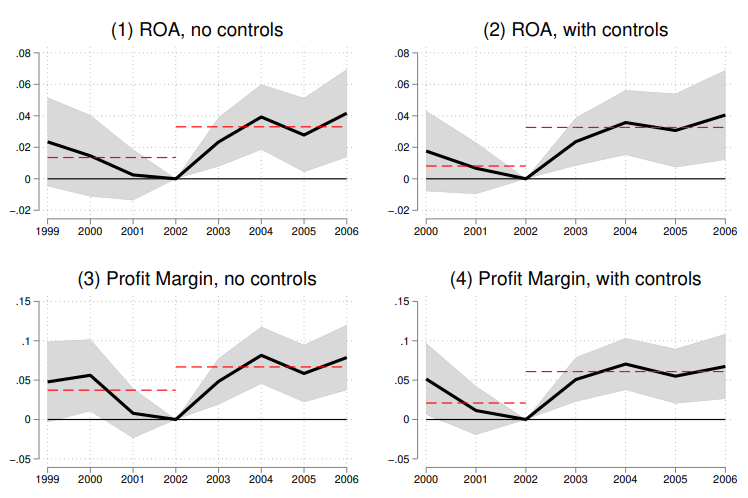

We provide causal evidence on the effects of mandated board independence. We compare firms that replace existing non-independent directors to firms that retain these directors by reclassifying them as independent. Reclassification eligibility, being largely predetermined, offers quasi-exogenous variation in compliance strategies. We show that firms required to replace insiders perform worse post-mandate, driven by increased operational costs and reduced labor efficiency. Boards of non-reclassifying firms retain fewer former employees and replace them with directors more likely to join monitoring-focused committees, emphasizing the shift from advising to monitoring. Overall, these findings suggest that firm-specific director expertise contributes materially to performance and is consistent with pre-mandate board compositions optimized to balance benefits of enhanced monitoring against costs of reduced advisory capacity. We rule out alternative explanations, including adjustment costs due to director turnover and co-option. Our study underscores the importance of allowing firms flexibility in governance structures and cautions against uniform mandates.

Working Papers

Patent Disclosure and Reliance on External Financing (with Kathleen Weiss Hanley, Sungjoung Kwon, William Mann, Qianqian Yu)

NPR Style Summary

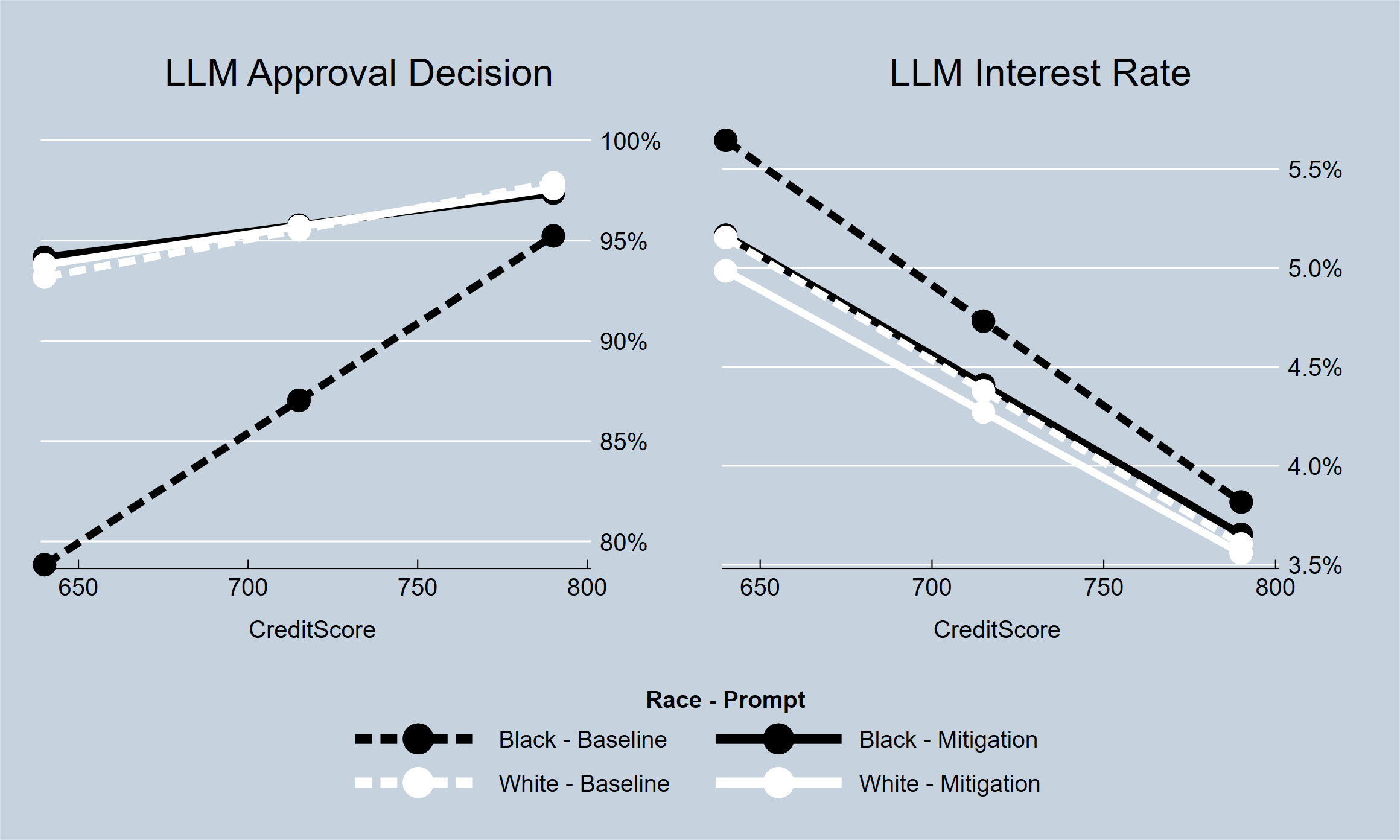

Measuring and Mitigating Racial Disparities in LLMs: Evidence from a Mortgage Underwriting Experiment (with McKay Price, Luke Stein, and Ke Yang)

(Ask AI about the paper) (Machine readable version)

Best Paper Award at the 2024 New Zealand Finance Meeting

Media mentions:

NPR Style Summary

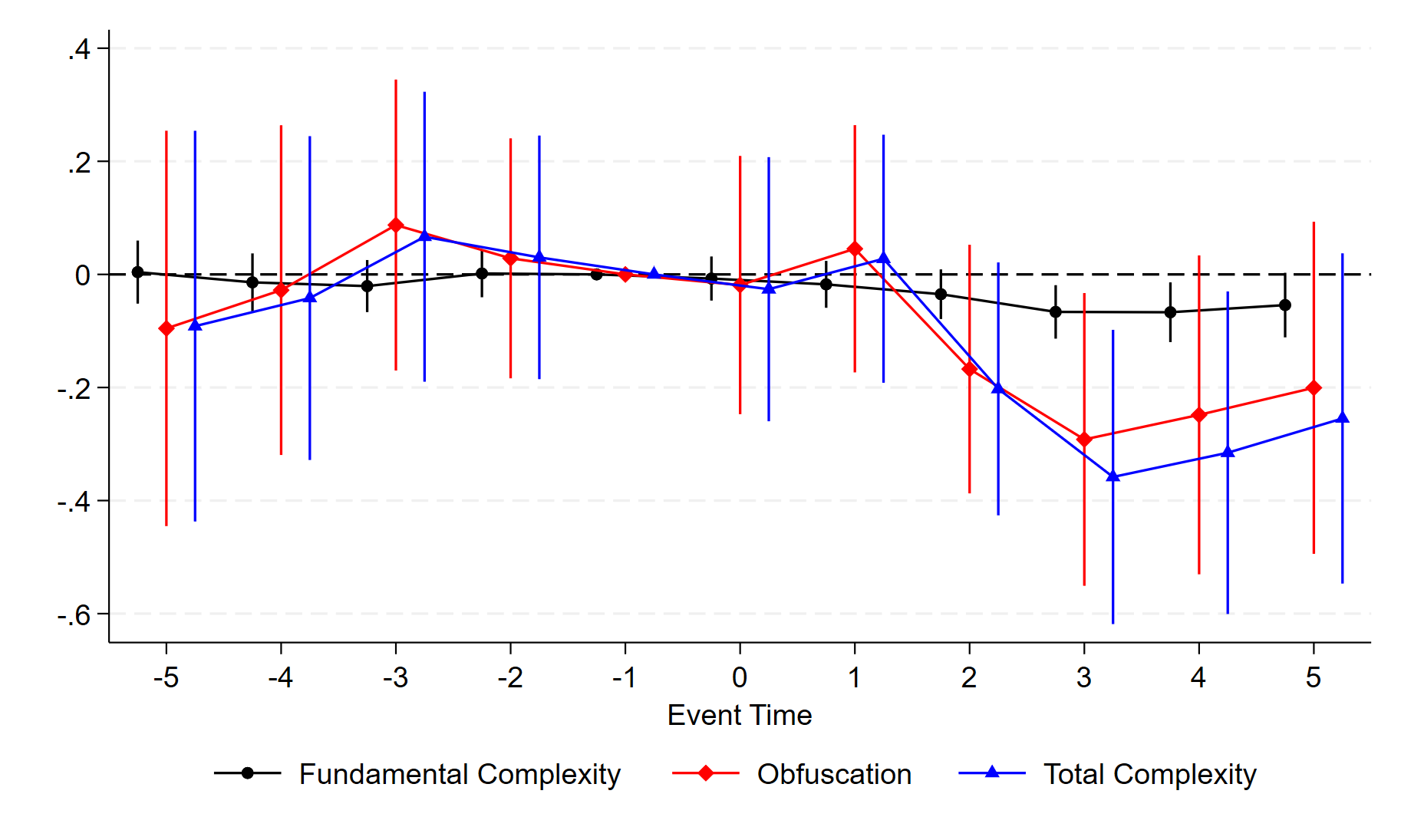

We evaluate LLM responses to a mortgage underwriting task using real loan application data. Experimentally manipulated race is signaled explicitly or through borrower name/location proxies. Multiple generations of LLMs recommend more denials and higher interest rates for Black applicants than otherwise-identical white applicants, with larger disparities for riskier loans. Simple prompt engineering can cost-effectively mitigate these patterns. Race-blind recommendations correlate strongly with real lender decisions and predict delinquency, but LLMs incorporate racial signals when available despite similar delinquency rates across groups. Our findings show potential costs of adopting this new technology in financial settings and raise important questions for regulators.

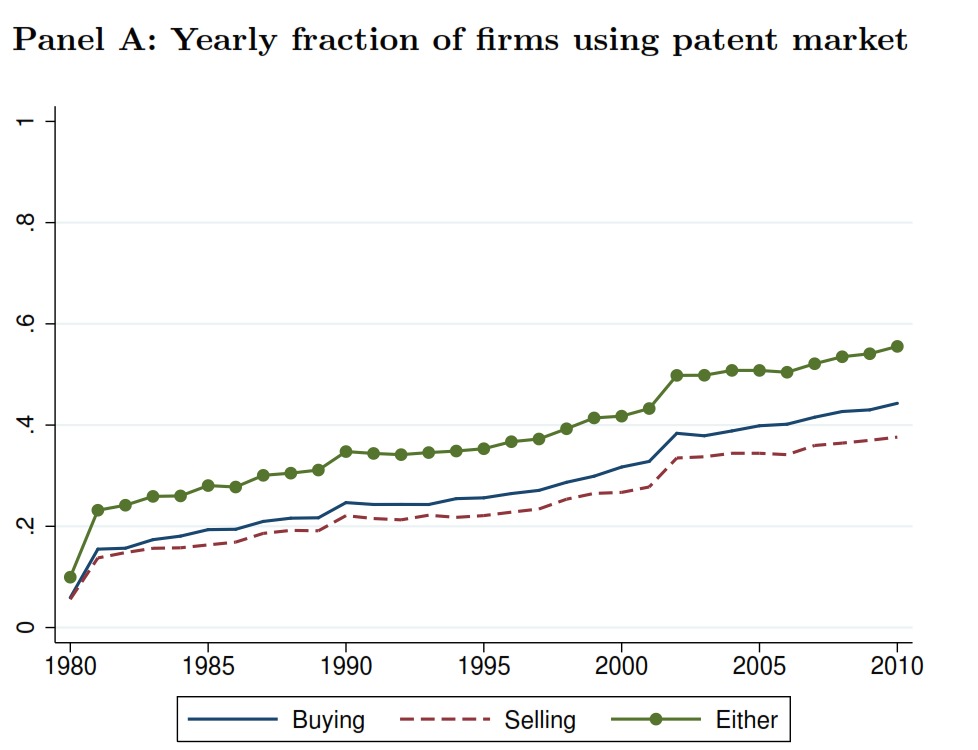

Patent acquisition, investment, and contracting

Best Paper in Innovation and Entrepreneurship from the Ed Snider Center for Entrepreneurship and Markets, 2017

Numerous works have examined the finance-related implications of intellectual property that is generated internally or acquired through M&A activity. The transfer of intellectual property via the secondary market for patents has received less attention. This paper fills that gap by asking how patent acquisitions interact with firm investment policy. I find that patent acquirers subsequently invest in more R&D, increase internal patenting, and eventually make new investments in CAPX. Firms with more technological expertise and investment opportunities acquire more patents. Patent sales are the dominant type of contract and maximize investment incentives; patent licenses frequently contain royalties, which induce underinvestment problems. Nevertheless, licensing can be explained in part by financial and strategic considerations. Licensing is more likely when buyers become financially constrained, when revenue can be shifted to low tax sellers, and when the buyer is a competitor acquiring rights to a valuable patent. Overall, these results suggest patent acquisitions are motivated by the pursuit of investment synergies, rather than innovation substitution, commercialization motives, or legal threats.